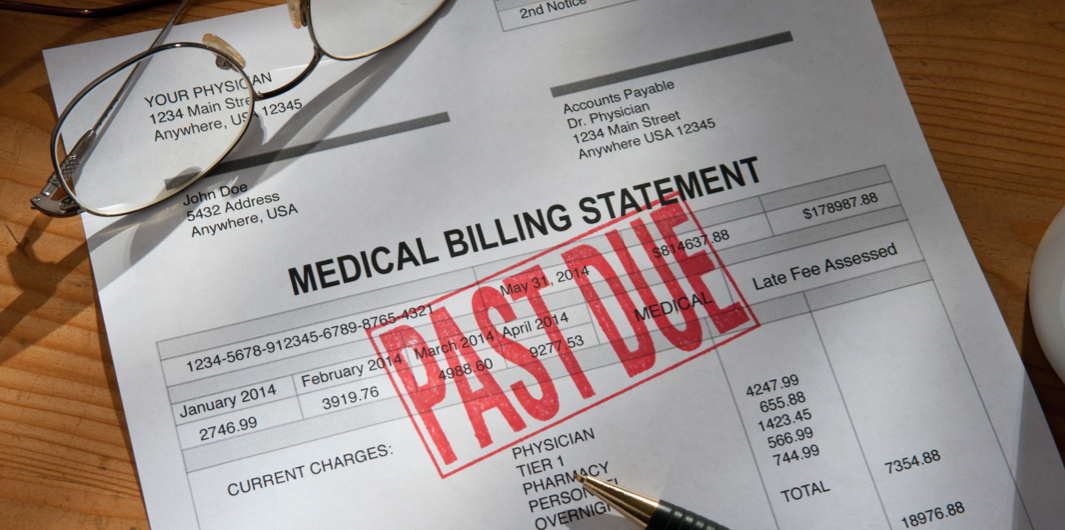

You just got your bill from the hospital and there are a lot of big numbers in front of you and you’re getting really confused about what you’re paying versus what insurance and the hospital are taking care of. Let’s break it down.

The main focus and concerns surround charges. A hospital bill will list the major charges, any services (procedures, tests, etc.) as well as medicines and supplies. A helpful tip is to ask for a more detailed bill with all the charges described separately to make sure the bill is correct.

For those that are insured, you’re going to get a form, not a bill, from your insurance company called an Explanation of Benefits (EOB) which will explain the following: what is covered by your insurance, amount of payment made and to whom, and your deductible or coinsurance. Your EOB should match your hospital bill and if it does not or you don’t understand something, you should absolutely call your insurance company.

So, now that you have your bill and your EOB it’s time to check for any errors to make sure you’re being billed correctly. Here are the main things to check:

- Dates and Number of Days: double check that dates match, especially for your admittance and discharge

- Number Errors: if a number seems too high or beyond what was estimated double check that there’s no extra zeros added after the number (a $100 fee turning into $1,000 can be really scary)

- Medicine Charges: if you were prescribed generic make sure you’re not being charged for the name brand or if you brought medications from home make sure you’re not charged for them by accident

- Charges for Routine Supplies: things like gloves, gowns, sheets, etc. should be part of hospitals’ general costs, question if you’re being charged for them

- Costs of Reading Tests/Scans: this should only be a one-time charge unless you got a second opinion

- Cancelled Items: make sure any tests, procedures, or medicines that may have been ordered but were later cancelled don’t show up on your bill

Then, there’s the question of: did I get a fair deal? Firstly, it’s important to know how hospitals are getting paid. Hospitals provide services and are then reimbursed for said costs by the government via Medicare/Medicaid. Insurance pays the hospital based on a diagnosis related group (DRG) which is essentially a bunch of complex and rather confusing set of formulas that calculate the amount of money to pay for a particular disease process or procedure. The formulas take many things into consideration such as the potential costs of complications, the cost of living in the hospital’s surrounding area, and the complexity of the medical procedures.

This process of formulaic calculations is what accounts for cost and reimbursement discrepancies across different hospitals. And this is where Hi-Neo can help you. Through the app, Hi-Neo gives you the power of price transparency and cost comparisons. You can have the power to make informed financial decisions about your health and know that you are getting the best possible care at the best possible price.

For more information on health and the medical world please visit our website and blog.